Financial Markets in Continuous Time

|

|

Описание:

Book DescriptionIn modern financial practice, asset prices are modelled by means of stochastic processes, and continuous-time stochastic calculus thus plays a central role in financial modelling. This approach has its roots in the foundational work of the Nobel laureates Black, Scholes and Merton. Asset prices are further assumed to be rationalizable, that is, determined by equality of demand and supply on some market. This approach has its roots in the foundational work on General Equilibrium of the Nobel laureates Arrow and Debreu and in the work of McKenzie. This book has four parts. The first brings together a number of results from discrete-time models. The second develops stochastic continuous-time models for the valuation of financial assets (the Black-Scholes formula and its extensions), for optimal portfolio and consumption choice, and for obtaining the yield curve and pricing interest rate products. The third part recalls some concepts and results of general equilibrium...Похожие книги

| MOST Data Aquisiton tool for supply Module Автор: YUSUF USMANI Год: 2010 |

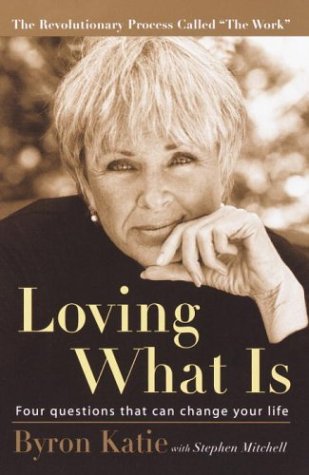

| Loving What Is: Four Questions That Can Change Your Life Автор: Byron Katie Год: 2003 |

| The End of Work Автор: John Hughes Год: 2008 |

| The Dutch Market For Agency Work: An econometric analysis of supply, demand and long term developments Автор: Debora Moolenaar Год: 2010 |

| The Now Habit at Work Автор: Neil Fiore Год: 2010 |

| The Politics and Philosophy of Michael Oakeshott (Routledge Studies in Social and Political Thought) Автор: Stuart Isaacs Год: 2006 |